seattle payroll tax ordinance

Businesses with 20 or more employees must allow covered employees to make a monthly pre-tax payroll deduction for transit or vanpool expenses. Seattle Rule 5.

How Commuter Benefits Will Work In Seattle Commuter Benefit Solutions

Imposing a payroll expense tax on persons engaging in business in Seattle.

. 1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or more but less than 100 million. Adding a new chapter 538 to the seattle municipal code. The payroll expense tax also known as JumpStart Seattle City Ordinance 126108.

Please note that although this rule is applicable to SMC 538 the individual rule. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. The 7 million threshold would be exempt.

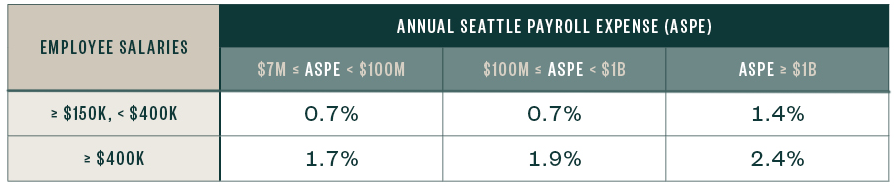

The tax sunsets on. Online Support for All Business Sizes. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business.

While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective January 1 2021. The draft rules address areas of ambiguity in the ordinance adopted by the Seattle City Council in July see PwCs Insight for more on the new payroll expense tax law. The ordinance includes a provision allowing apportionment of payroll expense for payroll related to work done and.

However businesses must use the current years compensation paid in Seattle to determine the payroll expense tax due for the year. And amending sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the seattle municipal code. To payroll tax would be imposed January 1 2021 and based on estimates using available government data would generate approximately 1735 million annually.

For example in 2021 businesses that had 7 million or more in Seattle payroll expenses in 2020 would apply the tax rates based on their 2021 Seattle payroll expense of employees with. Rule The payroll expense tax is computed on the total payroll expense paid in Seattle to employees with. Taxseattlegov or submit a written request to the License and Tax Administration offices 700 Fifth Ave Suite 4250 PO.

Ad Compare This Years 10 Best Payroll Services Systems. SEATTLE CITY COUNCIL. Imposing a payroll expense tax on persons engaging in business in seattle.

Easy-To-Use Online Invoice Software. This afternoon King County Superior Court Judge Mary Roberts ruled in favor of the City of Seattle upholding as constitutionally permissible the citys payroll tax enacted last summer and dismissing a lawsuit challenging it. An ordinance relating to taxation.

The table below shows the applicable tax rates. The rule helps to clarify certain language in the ordinance and provides examples for taxpayers on reporting and paying the tax. An employer may instead offer a partially or wholly employer-paid transit pass to satisfy its obligations.

Rule for the implementation of the Payroll Expense Tax Ordinance Seattle Municipal Code Chapter 538. A lawsuit has been filed challenging the Seattle tax and there is a draft. Adding a new Chapter 538 to the Seattle Municipal.

As shown in the table above for businesses with annual Seattle payroll expense greater than 7 million either a 7 or 14 tax rate. AN ORDINANCE establishing a spending plan for proposed use of the proceeds generated from the payroll expense tax authorized by the ordinance introduced as Council Bill 119810 establishing an oversight committee. AN ORDINANCE relating to taxation.

And the employee resides in Seattle. LEG Tax on Corporate Payroll Spending Plan ORD D10b. Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021.

Box 34214 Seattle WA. This ordinance would generate both one-time setup and ongoing administrative. On July 6 2020 the Seattle City Council voted 7-2 to pass Council Bill 119810 which imposes a Seattle payroll expense excise tax on large employers.

City Clerk File Created. Seattle Payroll at or above 1 billion. An overview of the ordinance follows.

Imposing a payroll expense tax on persons engaging in business in seattle. 3 CITY OF SEATTLE 4 ORDINANCE _____ 5 COUNCIL BILL _____ 6 title 7 AN ORDINANCE establishing a spending plan for the proceeds generated from the payroll 8 expense tax authorized by the ordinance introduced as Council Bill _____ to fund 9 immediate cash assistance for low-income. The legal challenge to the tax ordinance brought by the Seattle Metropolitan Chamber of Commerce argued that.

The Seattle Commuter Benefits Ordinance became effective on January 1 2020. And adding a new Section 335100 to the Seattle Municipal Code. The new rule is effective January 1 2021 and is the result of Seattle Ordinance 126108.

While the ordinance has not yet been signed by the mayor as of publication the tax. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Free Unbiased Reviews Top Picks.

Ord 126108 In Control.

Durkan Unveils 2021 Budget That Uses Jumpstart Tax To Fill Shortfall Fund 100 Million In Unspecified Bipoc Investments South Seattle Emerald

Seattle Jumpstart Tax Hkp Seattle

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Seattle Will Indeed Tax Amazon As 200m Jumpstart Tax On Big Businesses Approved Chs Capitol Hill Seattle

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Mandatory Municipal Commuter Benefit Ordinances Tri Ad

Seattle Approves New Payroll Expense Tax Grant Thornton

Seattle Payroll Tax Debacle Could Have National Repercussions

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

How Seattle S Head Tax Would Work The Seattle Times

Seattle Aims To Boost Affordable Housing With 24 Million In Payroll Tax Local Bigcountrynewsconnection Com

Seattle Payroll Expense Excise Tax Details

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Amazon Payroll Subject To New Seattle Tax And Jeff Bezos Is Wealthier Than Ever Washington Business Journal

How Amazon Killed Seattle S Head Tax The Atlantic

Seattle Payroll Expense Excise Tax Details

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax